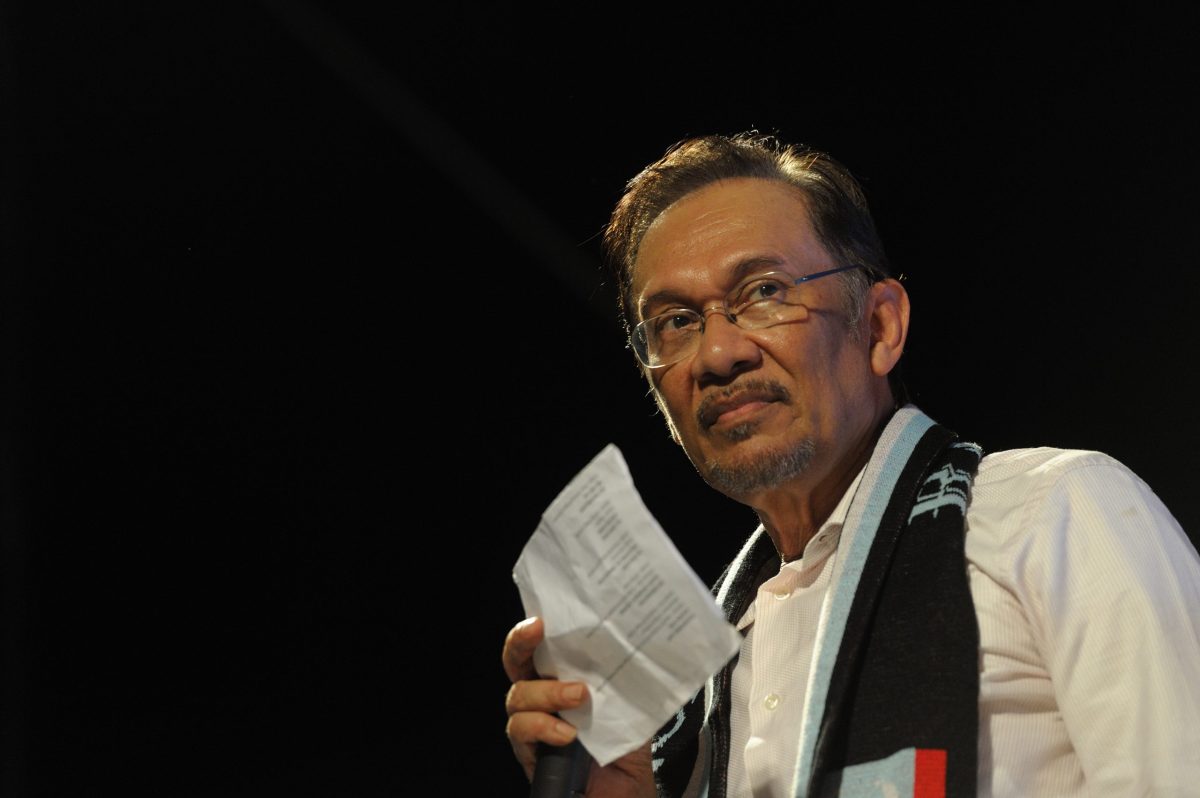

Following the completion of Anwar government’s first 100 days in office, we invited James Chin, Professor of Asian Studies at the University of Tasmania and an authority on government affairs in Southeast Asia, to share his views on the stability of the government and Malaysia’s political outlook.

This Insight summarises key takeaways from the discussion with Asia Management Forum and Asia Management Forum Global members, along with further analysis and commentary from our Research team.

Key takeaways

+ Anwar’s government has had a good start. But weak support from Malay voters could lead to Anwar’s fall unless his Pakatan Harapan (PH) coalition gains stronger Malay support in six state elections by July-August this year.

+ If Anwar fails to win over the Malay voters, then the opposition Perikatan Nasional (PN) coalition is likely to win the next general election, with a prominent place for the strict Islamist party PAS. That would not bode well for non-halal industries (movie theatres, alcoholic beverages, etc). The labour market would also suffer, as PAS is opposed to foreign workers and women working in factories.

+ Until a stable government is in place, the economic outlook will continue to be hurt by political uncertainties. We expect consumer spending and capex growth to stay sub-par over the medium-term, which will pull down overall GDP growth to 2.7% in 2023 and an average 4.2% over 2024-26. That compares with 5.8%pa for the decade to 2019.

Malaysia’s ethnic politics & election math

Malaysia’s political complexity comes down to two points: 1. Malays were 51% of the population in 2015 (ranging from 40- 90% in states on the peninsula) with any stable government needing the support of a majority of Malays, and 2. All Malays are Muslim, and conservative Islam is a rising force within the Malay community, which roughly divides at present into a rural and conservative group and an urban and progressive group.

The rest of the Malaysian community is made up of indigenous people in the east Malaysian states of Sabah and Sarawak (12% and collectively grouped with Malays as “Bumiputra”, which means son of the land), Chinese (21%, a steadily falling percentage), Indians (6%), and non-citizens who are mostly migrant workers (10%).

For three decades to 2018, political stability was delivered by the Barisan Nasional (BN), a broad coalition that included the main parties for the main ethnic groups. The United Malays National Organization (UMNO) led BN, and collected most of the Malay votes, with the help of extensive payments to key Malay voting groups (such as rubber growers) via the government budget and informal funds flowing through UMNO. In the 2018 election, voters threw BN out of office after UMNO’s informal funds flow became a spectacular river of corruption - including 1MDB - under PM Najib Razak.

Coalitions and parties fragmented in the 2018 election with the turmoil continuing as three Prime Ministers (Mahathir, Muhyiddin, and Ismail) each briefly attempted and failed to form stable governments. The 2022 election brought a major realignment. UMNO crashed to 26 seats from 54 in 2018 and 88 in 2013. The BN coalition it leads fell to 30 seats from 79 in 2018 and 133 in 2013. Part of BN’s fall was due to a split in UMNO, with Bersatu (Malaysian United Indigenous Party) created in 2017 and taking 13 seats in 2018 and 31 seats in 2022. Meanwhile, the Islamic-based PAS surged to 43 seats (making it the largest single party in parliament) from 18 in 2018 and 21 in 2013.

Given the dramatic realignment in parties in 2022, Anwar did well in forming a coalition of 148 out of a total 222 seats (66.7%) to win a confidence vote in December 2022 with support from his own PH coalition (82 seats), UMNO and the remnant of the BN coalition (30 seats), GPS (a coalition from Sarawak, 23 seats), GRS (a coalition from Sabah, 6 seats), and seven others. Anwar’s PH coalition draws its support from five parties mostly representing urban middle-class Malays, Chinese, and Indians. The Sabah and Sarawak supporters in GPS and GRS while technically “bumiputra” are not Malays. UMNO and the remnant BN do represent Malays but are just 30 seats. Add to that the Malay party inside the Anwar’s PH coalition (People’s Justice Party, 31 seats) and you get to 61 seats representing the Malay community in Anwar’s government.

Bersatu and PAS in the PN coalition are the opposition with 74 all Malay seats. So, PM Anwar leads a reformist, multi-ethnic government, which despite holding two-thirds of the seats in parliament does not represent the majority of Malays.

Anwar’s government is not secure

In his first 100 days, Anwar has scored an approval rating of 68% (reflecting his popularity among the non-Malay communities, as well as progressive Malays), survived a confidence vote in parliament with a two-thirds majority, and tabled a well-received 2023 budget as the finance minister. He continues to enjoy strong support from UMNO, as well as the current King.

But the true test for his government lies ahead. The upcoming elections in the six states of Selangor, Penang, Negri Sembilan, Kelantan, Terengganu, and Kedah will be crucial in determining Anwar’s legitimacy in terms of having Malay support. The last three states are the Malay heartland states and are currently governed by the Islamic opposition party PAS. PAS also controls Perlis but it has no election this year. The four states - sometimes called the PAS belt - are rural, poor, 90%+ Malay, and a PAS stronghold thanks to decades of building Islamic schools. Several have also adopted stricter application of sharia law than other Malaysian states. PAS should easily hold them in the 2022 state elections although PM Anwar hopes to woo their voters with cash transfers in the budget paid to the bottom 20% of the national population.

The bigger issue is whether PAS and Bersatu can make inroads into the wealthier, urban states of Selangor, Penang, and Negri Sembilan. Bersatu may be held back as some of its leaders have been charged with corruption in COVID-19 programs, which will weaken its funding. Meanwhile, PAS’s leaders have moderated their positions from calls for strict Islam to appeal to urban Malays.

If PAS does well in the 2023 state elections, then UMNO and GPS (key members of the current government) may decide to dump Anwar and nominate a new PM in the hope of doing better in the next federal election. Meanwhile, the chances of the PN coalition (PAS & Bersatu) winning the next general election will increase. Although PN is led by ex-PM and Bersatu president Muhyiddin Yassin, PAS would be in a dominant position given it is the single largest party in the parliament.

Key issues for businesses

Government relations and the rising “green wave”

In the short-term, Anwar’s government aims to get the economy back on track and implement the budget. Policy implementation is in the hands of a well-regarded team that includes Rafizi Ramli (Minister of Economy), Tengku Zafrul (Minister of International Trade and Industry), Saifuddin Nasution (Minister of Home Affairs), and Steven Sim (Deputy Finance Minister).

After the state elections, there could be a shake-up in the top echelons of the bureaucracy, which is currently seen as an obstacle to delivering the budget. One key change already made has been the appointment of Johan Merican as secretary-general of the Treasury. He is a strong reformer and Anwar will largely rely on him to carry out changes, based on the suggestions of his newly constituted advisory committee (headed by the Petronas CEO).

In the longer-term, a government that includes PAS, will likely shift towards more towards Islamic policies (even if PAS doesn’t have the office of PM). Non-halal enterprises, such as breweries and certain food products, and entertainment will suffer. PAS is also opposed to foreign workers and women working in factories. If implemented, this will affect labour supply and lower Malaysia’s long-term potential growth. A survey of the PAS governed states shows a mixed record. Kelantan is largely driven by women entrepreneurs, but the party recently passed a law in Terengganu that restricted women’s rights.

Cautious consumers

Following average 7.1% growth in the decade to 2019, consumer demand growth slumped to 3%pa in 2020-22. We expect it to remain at 3% in 2023, before lifting to an average 5.1% over 2024-26. While the 2023 budget has continued with subsidies and raised social assistance for households, a budget deficit above 5% of GDP means that the government cannot keep pumping cash into consumers’ pockets without running into trouble with the rating agencies.

At 60.4% of GDP, Malaysia’s public debt is higher than similarly rated peers. Unless the GST is reinstated to raise revenues, which is unlikely for the next two years at least, it will have to rely on rationalizing expenditure to keep fiscal risks under control and borrowing costs stable around 4%pa.

Infrastructure spending delays

Frequent government changes have hurt Malaysia’s capex plans in recent years. After averaging 6.2%pa in the decade to 2017, capex has contracted at an average pace of 1.9%pa over 2018-22. The shortterm outlook remains depressed with 3.3% growth expected in 2023. As apparent in the budget, the government’s funds are constrained, and costly infrastructure projects have been put on the backburner. Eventually, the big projects that were negotiated by the prior governments, for example the flood mitigation projects and the East Coast Rail Link, will be revived. But the timing will depend on the progress of economic recovery.

This could turn into a vicious cycle with persistent delays on infrastructure development further slowing the economic recovery. It could also dent Malaysia’s attractiveness as a “China+1” alternative overtime, especially as rivals India and Indonesia double down on capex spending.

Foreign labour is a political flashpoint

Foreign labour has become a politically contentious issue, following the exposure of corrupt hiring practices that implicated senior officials from past governments. Anwar’s government is also worried about foreigner workers undermining the employment of locals. Adding to the problem is a large number of illegal labourers (the World Bank estimates that of the roughly 3m foreign workers in Malaysia, 43% are not officially registered). In addition, leading local exporters like Top Glove have been accused of using forced labour.

The official count of low-skilled foreign workers puts them at 15% of the workforce and their slow return after covid restrictions were lifted in Feb’22 has contributed to an estimated shortage of 1.2m workers across the manufacturing, plantation, and construction sectors. The government has been cautious in fixing the problem with approval delays contributing to the shortage. The rules on hiring foreign labour were briefly relaxed for Q1’23 only, with the government warning firms not to hire at the expense of local job seekers.

A balanced foreign policy

The Anwar government, like its predecessors, will continue to balance its relationships with the US and China. Despite its geographical location making it quite vulnerable to South China Sea developments, Malaysia is unlikely to take an aggressive stance against China. Anwar is more focused on projecting Malaysia as a middle Islamic power. To this extent, he is trying to revive relations with the Organisation of Islamic Cooperation (OIC) and strengthen ties with the Middle East.

Dive deeper.

Explore the implications for business and strategy.

Log in for the full Market Insight.

Join the peer-group discussion at upcoming Forum events.

Not yet a member?

Contact us to learn more.