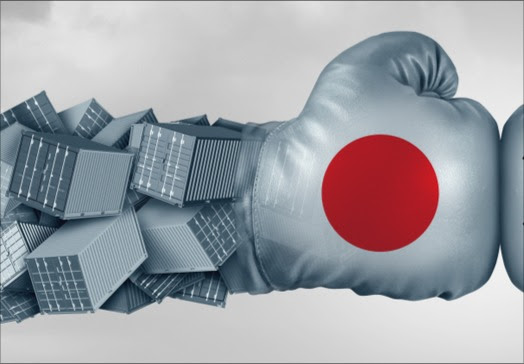

Signs of rising protectionism amidst the country’s push for self-sufficiency are concerning to China CEOs.

'Nationalism is on the rise. We were excluded from public bidding in steel, which is not a sensitive sector.’

'Guest speakers advised us that increasingly big Chinese companies only want to work with 100% locally supplied firms. If you cannot prove you are sourcing locally, you are out.'

Foreign firms don’t have to accept the cold shoulder treatment. CEOs can influence how their firm is regarded if they sell their firm’s China story often and well. Setting the record straight matters.

‘I am working much harder on our storytelling. We have local IP and 95% local manufacturing, so our products are made here. We must act because this (nationalism) will only get worse. The competition is using our foreign name as an argument against us.'

It starts with how CEOs assess their firm's contribution to the Chinese economy. In many instances, official statistics underreport a foreign firm's impact. CEOs need to prepare themselves with the right data points, and these need to cover ‘new-quality productive forces.’

Investment has long been a key selling point. Since FDI numbers are declining, Chinese stakeholders may consider foreign firms less relevant. However, official FDI figures don’t capture today’s picture.

'We invest internally, but this is not counted as FDI. When we start a new legal entity, we do an equity injection until it’s self-sustaining. Most of our investments are with locally generated cash.’

FDI was once a helpful statistic, but it's less so now. China's CEOs should highlight what’s most important: their firm’s investment is here to stay, and more will come.

'I pass this message to officials: MNCs in China will keep investing over the next ten years. However, firms not yet in China are less likely to bring in FDI. The definition of FDI should include cash generated in China that would get sent back as dividends in other markets. The China investment thesis is still strong.’

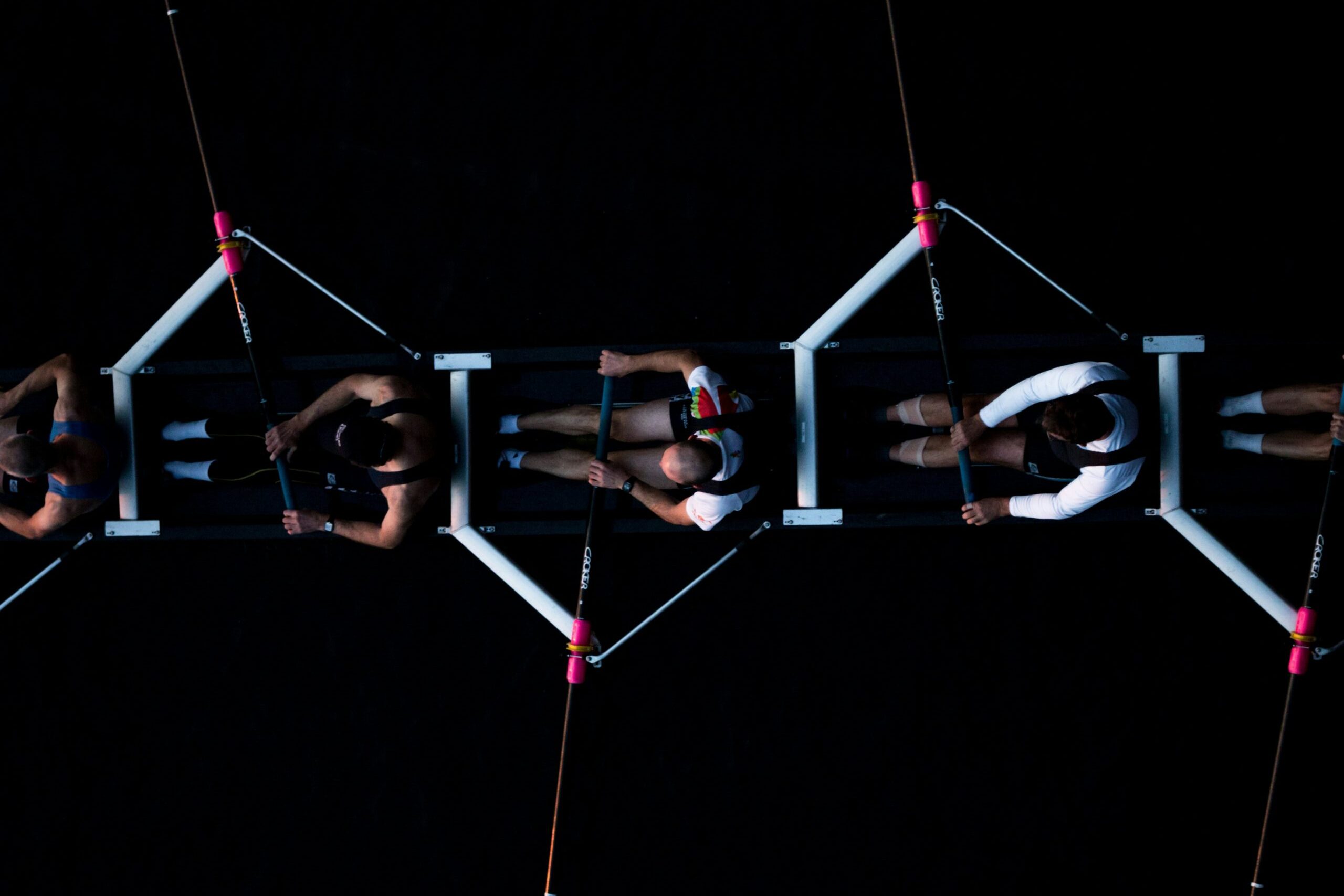

Not all foreign firms feel the chill of 'nationalism’. Some have developed thriving partnerships with local firms. One is worth noting for its innovative structure.

‘We are five years into a partnership with a Chinese firm that’s only getting warmer. We own 20%, the Chinese side has 30%, and the other half is floated on the HKSE. Our partner has sent signals to increase communication on topics beyond the core partnership. This is because we have a solid level of trust.’

Chinese firms still need and want to partner with foreign firms. The key is to find a point of mutual interest. A classic pairing is a foreign premium brand with a Chinese distributor, but in 2024, consider shared ownership rather than a JV or licensing deal.

‘China is the biggest market in the world for us, but we needed more scale and route to market. We have premium brands, however. Put the two together; theoretically, you have magic, which is what we've shown. Last year, we grew 60%, and this year, we will grow 20% to 30%. The partnership is a financial success for both parties.’

Firms can consider being more creative with their China investments, and China CEOs must sell their firm’s value widely.

Deepen your understanding & explore the implications for business and strategy.

Log in for reports that capture business insights from recent Forum briefings.

Join your peers at upcoming Forum events.

Not yet a member?

Contact us to learn more.